Growing fast with atoms

Building in atoms vs bits doesn't mean slower growth

One of the biggest misconceptions about companies building in atoms and not just bits is that they necessarily have to scale revenue more slowly.

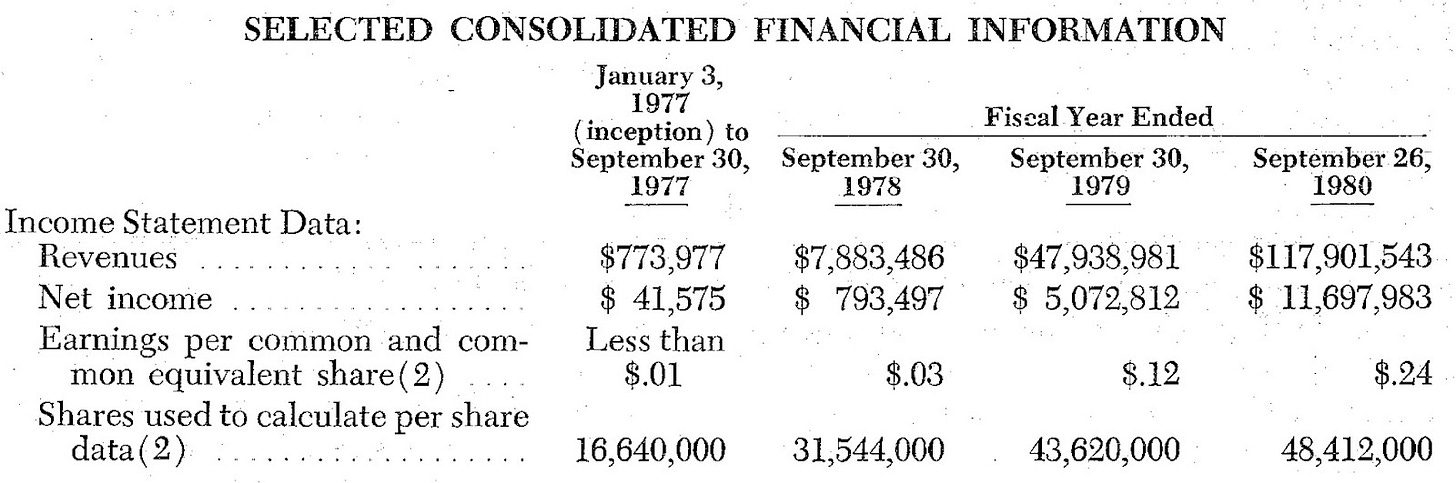

While it’s true that some deep tech companies required years of engineering before being able to sell a complete product (e.g. SpaceX, Tesla), many of the best companies building in atoms scaled revenue extremely fast by launching a product soon after founding. Apple Computer brought in $774k in year 1, $7.9m in year 2, $48m in year 3, and $118m in year 4 after founding. It looks even better inflation adjusted.1

Apple is not alone. One year after company founding in 1939, HP had made $121,092 (inflation adjusted) selling resistance-capacitance audio oscillators. Four years later revenue hit $10m (inflation adjusted).2

AMD was founded in May 1969 and by November had manufactured their first product: the Am9300, a 4-bit MSI shift register. Sales began the next year and 2.5 years after founding AMD’s annual revenue hit an inflation-adjusted $35.6m.3

NVIDIA took two years after its founding in April 1993 to begin selling its first product. Once it launched the NV1, one of the first 3D graphics accelerators, it took only 6 months for NVIDIA to make $2.4m in inflation-adjusted revenue.4 That’s over twice a fast as a top decile SaaS startup takes to get to a similar ARR after launch.5 The next year, NVIDIA’s inflation-adjusted revenue hit $7.8m, followed by $57m in 1997.

These early growth stories stack up well when compared to some software darlings. It took Figma over 3 years to have a live product, ~5 years to start generating revenue, and ~6 years to hit $1m ARR. Loom took ~4 years after founding to hit $1m ARR, Linear took ~3.5 years, and Segment took ~3 years.6 Ramp, one of the fastest growing software companies in modern times, took ~10 months from founding to hit $1m ARR – slower than Apple and at least one Fifty Years portfolio company that’s building in atoms.

Don’t let anyone tell you building in atoms necessarily means slower growth. Some of the fastest to grow startups in history did so by manufacturing advanced physical goods. And when they do scale, they typically have stronger moats than your typical SaaS startup.

Thanks to Gaurab Chakrabarti, Sean Hunt, D. Scott Phoenix, Ela Madej, and Leo Polovets for offering feedback on drafts of this post.

Used to inflation-adjust all numbers: https://smartasset.com/investing/inflation-calculator

Non-inflation adjusted AMD revenues were $5,369 in 1939 and $121,092 four years later. https://www.reuters.com/article/idUSTRE67E0X7/

Non-inflation adjusted $4.6m. https://en.wikipedia.org/wiki/AMD

Non-inflation adjusted, NVIDIA did $1.2m 6 months after the NV1 launch, $3.9m the next years, and $29m the year after that. https://content.edgar-online.com/ExternalLink/EDGAR/0001012870-98-001089.html?hash=ee81d32a4d7761eb66e97e059e0feee0cd14665f5141f39721dbb0ade212d6d9

https://chartmogul.com/reports/saas-growth-report/2023/

lennysnewsletter.com/p/scaling-your-b2b-growth-engine

Remiss not to mention Li Auto here, same class of 2015 as OpenAI. $17B in revenues last year as an 8 year old company, up more than 160% from the year prior. Compare that to a $2B optimistic estimate for OpenAI’s revenues last year. The fastest growing hardware startup perhaps ever.

As a PHEV/EV startup, do not even compare it to Rivian by top or bottom lone growth. As a Chinese startup it is a kick up the backside for the US to build more consumer hardware companies and do it faster.